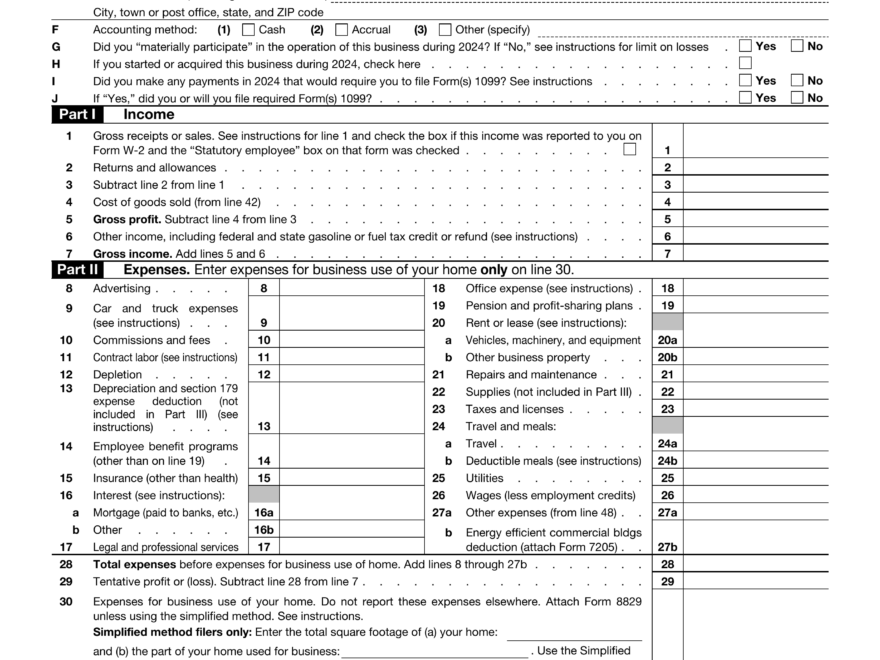

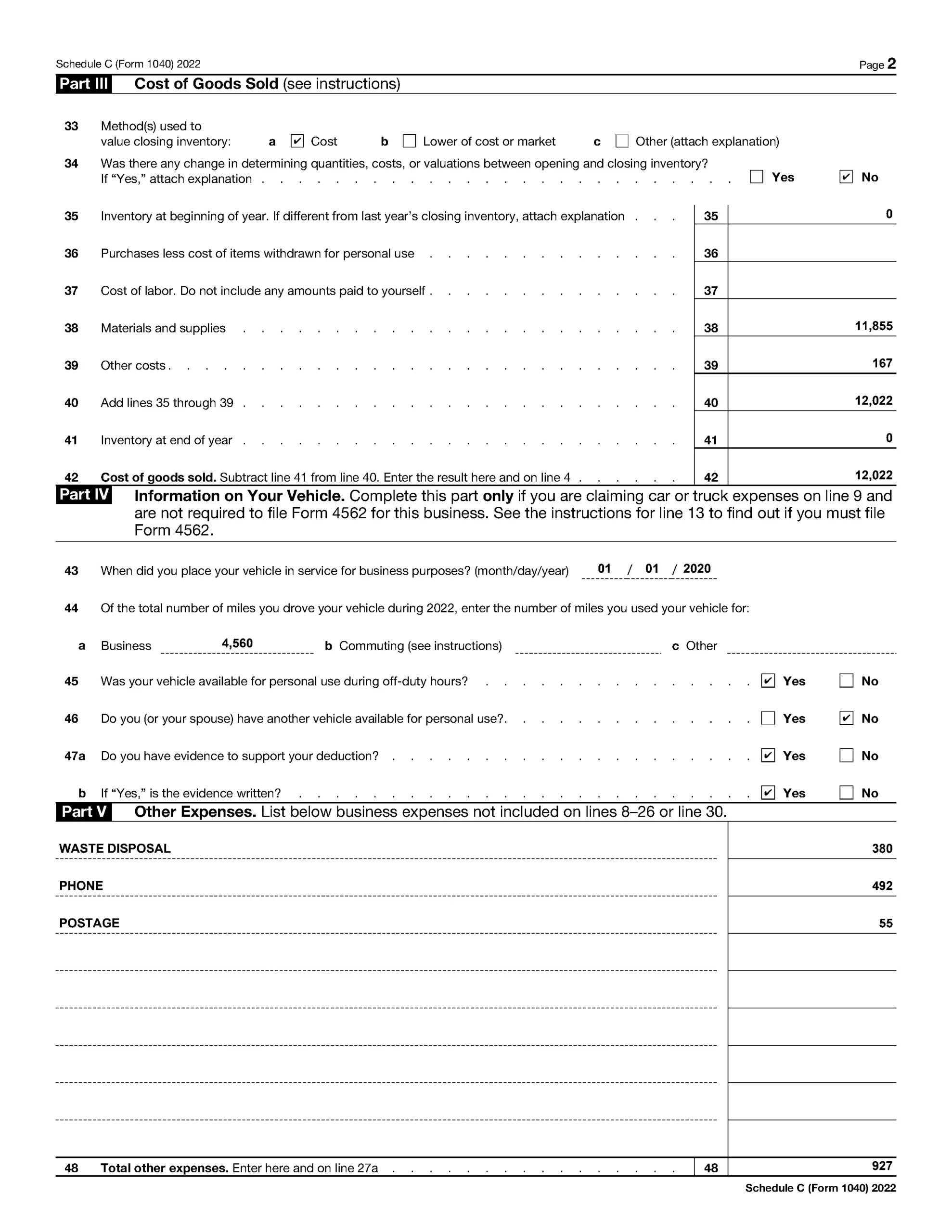

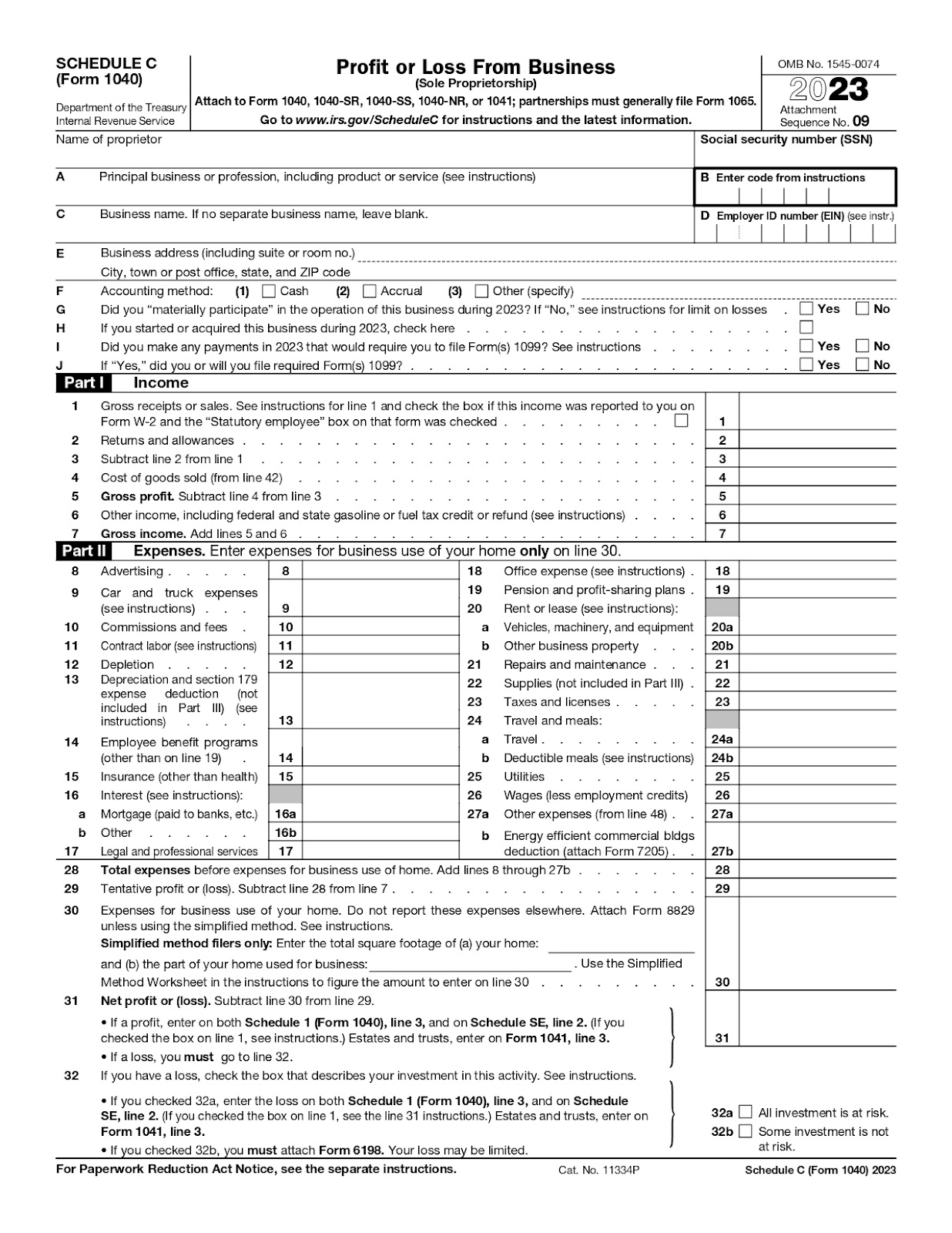

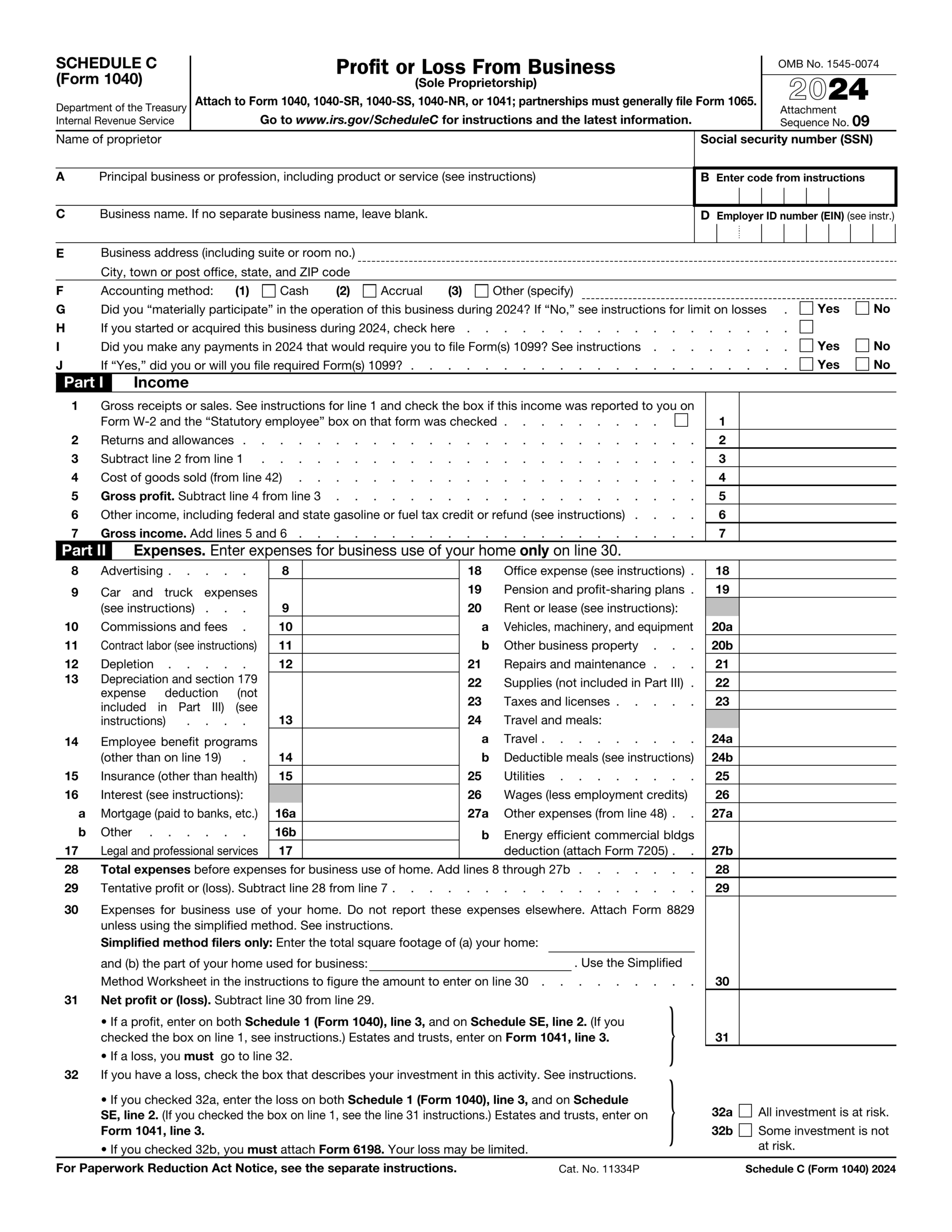

Are you looking for a hassle-free way to file your taxes this year? Look no further! With the Free Printable Schedule C Tax Form, you can easily organize your business income and expenses.

This form is specifically designed for sole proprietors and freelancers who need to report their self-employment income. It helps you calculate your net profit or loss, which is then transferred to your personal tax return.

Free Printable Schedule C Tax Form

Free Printable Schedule C Tax Form

One of the great things about this form is that it’s available online for free. You can download it, fill it out, and submit it along with your tax return. It’s a simple and straightforward way to stay compliant with the IRS.

By using the Schedule C form, you can deduct business expenses such as supplies, equipment, and marketing costs. This can help lower your taxable income and potentially save you money on your tax bill.

Remember to keep detailed records of your business transactions throughout the year. This will make it easier to fill out the Schedule C form accurately and ensure that you’re not missing any deductible expenses.

So, if you’re a self-employed individual looking for an easy way to report your income and expenses, consider using the Free Printable Schedule C Tax Form. It’s a convenient tool that can help simplify the tax filing process and keep you organized all year round.

Don’t let tax season stress you out. With the Free Printable Schedule C Tax Form, you can take control of your finances and file your taxes with confidence. Download the form today and see how easy it is to stay on top of your self-employment taxes!

Essential Tax Forms For U S Individuals

1040 Schedule C 2024 2025 Fill And Edit Online PDF Guru