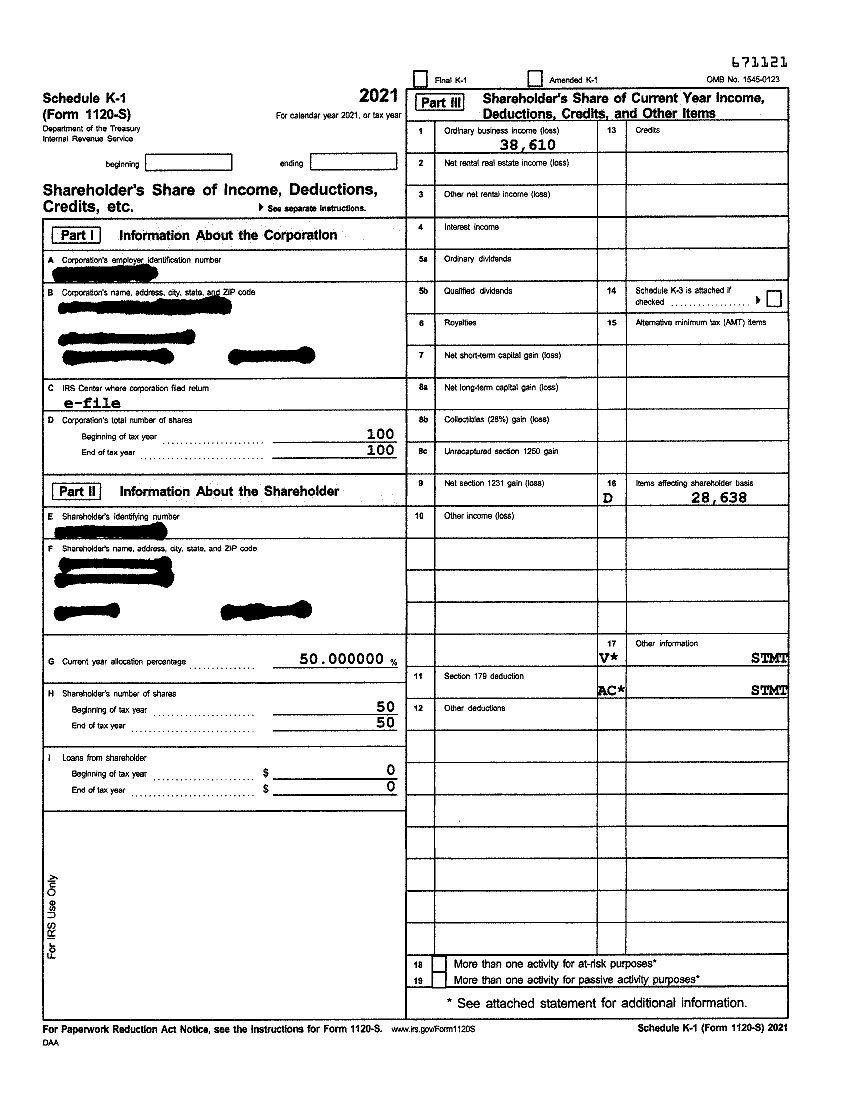

Are you looking for a convenient way to keep track of your income as a shareholder in an S Corporation? A Printable Schedule K-1 1120s might be just what you need! This document outlines your share of the company’s profits, losses, deductions, and credits for tax purposes.

By using a Printable Schedule K-1 1120s, you can easily report your income and deductions on your personal tax return. This form is essential for shareholders of S Corporations to accurately calculate their tax liability each year.

Printable Schedule K-1 1120s

Benefits of Using a Printable Schedule K-1 1120s

One of the main benefits of using a Printable Schedule K-1 1120s is that it simplifies the process of reporting your income. Instead of trying to decipher complex financial statements, this form provides a clear breakdown of your share of the company’s finances.

Additionally, a Printable Schedule K-1 1120s can help you maximize tax deductions and credits by ensuring you are claiming all eligible expenses related to your ownership in the S Corporation. This can result in significant tax savings for shareholders.

Furthermore, having a Printable Schedule K-1 1120s on hand makes it easier to provide accurate information to your tax preparer or accountant. By having all the necessary details in one document, you can streamline the tax filing process and avoid potential errors or discrepancies.

In conclusion, utilizing a Printable Schedule K-1 1120s is a smart and efficient way for shareholders of S Corporations to manage their tax obligations. By maintaining accurate records and staying organized, you can ensure compliance with IRS regulations and maximize your tax savings each year.

Schedule K 1 Form 1120 S Print And Sign Form Online PDFliner

3 0 101 Schedule K 1 Processing Internal Revenue Service